Chapter 01

Connecting

with customers

in a

Zero-Contact

World

Introduction to the research-

our methodology and findings.

It would be fair to say that no organisation across the globe could have fully prepared itself for the fallout of the COVID-19 pandemic. The implications of this on brands and businesses are going to be transformative. While the near-term will be challenging, our study indicates that the long-term impact will be positive on brands who are willing to embrace and evolve in the ‘new normal’

Terms such as ‘Social Distancing’, ‘Zero- Contact’ & ‘Lockdown’ are here to stay. We are already witnessing changes across the globe, as well as closer home, in how India operates in the middle of a lockdown. It’s especially evident in the way authorities and consumers have defined what constitutes ‘essential’. It’s also visible in how consumers are accessing these essentials, finding new ways to entertain themselves, and adopting new behaviours while being confined to their homes.

It is equally important to note that these changes are not specific to any particular customer segment. On the basis of our interaction with about 200 customers, we’re seeing fundamental habits and behaviour are being realigned regardless of age, gender and other demographics including views on recovery, impact on their lifestyle, and consumption choices around dominant categories.

"The brands that are going to win are going to be the ones that have deep connections”

Chip Bergh

CEO - Levi Strauss

Image source: www.levistrauss.com

Chapter 02

The

Contact List

An overview of the participant demographic.

We reached out to working professionals across various age and income groups to get an understanding of their sentiment. The total number of completed surveys was 189, with a male : female split of 119 : 70.

Most of the responses received (80%) were from the 3 cities of Mumbai, Delhi and Bangalore. 80% of the completed surveys were from respondents below the age of 40. Maximum respondents were from the 25-40 age group(74%)

189

119

70

Cities

Mumbai

77

Bangalore

68

Delhi

06

Others

38

Age

group

18-25

11

26-30

48

31-40

91

40+

39

Chapter 03

Then and Now

How COVID-19 is likely to impact the lifestyle and spend patterns of consumers

If history has taught us anything, it’s that a crisis leads to a lasting change in attitude and behaviour among people - the second World War lead to the inclusion of women in the workforce, 9/11 lead to numerous changes in security policies across industries, and the SARS epidemic caused an exponential increase in e-commerce in China. While we can only speculate about what long-term changes the Covid-19 pandemic will have on the world,

consumers have already started

displaying changes in their lifestyles,

choices and spends as they plan

for life in the ‘new world’.

Experiences used to matter:

Pre COVID-19, we lived in an age of experiences. Travel was considered by most as an investment into quality of life. Consumers we spoke to, across age groups, spent more on travel than they did on education or fitness. However, this is also likely to be the biggest change in a consumer’s lifestyle, at least from a short-term perspective.

Those surveyed mentioned travel and entertainment (including social activities) as the categories that will see a significant reduction in their monthly expenditure.

Overall, the need for ‘social experiences’ in the lifestyle of urban consumers is likely to become the first casualty of the pandemic.

It’s time to save:

Now, over half of all respondents indicate their intent to increase their personal investments. Close to 25% of the monthly spend by the consumers surveyed are in different forms of financial investments. The Covid-19 pandemic and its impact on the economy has made consumers realise the need for saving in the future.

As a consequence, the share of wallet that brands and categories compete for will reduce. Every consumer will question his/her spend and whether it is worth the investment.

Q: What was your average monthly spend on the categories mentioned before the pandemic?

“I have already become a lot more conscious of what I am buying. I read the box. This is a good habit honestly”

Lifestyles won’t change. Levels of consciousness will.

Basis our survey, the average monthly spend on apparel was more than the spend on fitness or personal care in the pre-Covid-19 era. Most consumers admitted to not realising the amount, they spent on apparel and other ‘indulgence purchases’ each month. Interestingly, while a number of consumers indicated that apparel and cosmetics are spends they are likely to reduce, they also did not see their lifestyles changing much in the next 12 months.

They will continue to spend on education, household products, OTT, fitness, and personal care.

Moreover, the level of consciousness even on discretionary spends will increase. The fine print will be read. Brands and categories will have to compete for ‘share of value’ in the life and lifestyle of the consumer.

Q: How are your spends on the below categories likely to change post COVID19?

Entertainment at any cost:

Pre-Covid-19, online entertainment was ranked Top 3 on spends. This held true for the 40+ age demographic as well. Between Netflix, Hotstar, Spotify, BookMyShow and other OTT platforms, close to 12% of the average monthly spend was on online entertainment. Even the pandemic, and potentially a recession, are unlikely to impact this spend. In fact, close to 25% of the consumers surveyed have increased their monthly investment in online entertainment. And this will continue as we transition into the new world.

Consumers will continue to invest in their lifestyles, but more rationally. They will exhibit more caution and less impulse. Brands and categories need to adapt. They will need to justify their place in the lifestyle of the consumer. The focus will need to shift from building ‘brand love’, to developing genuine ‘brand value’.

We are emotional beings. But the ‘new normal’ world will be a lot more rational.

Chapter 04

Essentially,

it’s the same?

What ‘essential’ really means in the context of today.

When the Government Of India announced the 21-day lockdown effective midnight of March 24th, most Indians were wondering what constituted essential services aside from medical, healthcare & emergency services.

While all manufacturing and supply chains were disrupted, it was a relief for consumers to see online delivery (Zomato, Swiggy, Dunzo) and online groceries (Amazon, Big Basket, Box8, Licious) being allowed to operate. The situation also saw the emergence of online platforms like MyGate, a new age platform that stepped up to help authorities in the issuance of special passes for delivery executives.

Needless to say, businesses that operate in categories that have been labelled ‘essential’ by consumers have a responsibility to be reliable, accessible, and protect their customers’ privacy. In parallel, brands/ services that have not been labelled ‘essential’ need to build relevant associations and partnerships (with essential players) to stay engaged with their customers.

Through this survey, we’ve tried to understand what constitutes ‘essentials’ in the minds of the consumer, their current sentiment, and their future outlook.

The Kirana Store

The kirana is probably the best example of building a direct relationship with customers. In all our conversations, we’ve realised the importance of the local store in the daily lives of the consumer, especially in India. While everything around us changes post-Covid-19, this channel will continue to be the most trusted for daily needs, as long as they continue to practice the principles of social distancing and zero physical contact.

Online Delivery

It comes as no surprise that a service like food delivery has become essential. Our learnings from this survey suggest a decrease in the importance of a kitchen in the household of the ‘millennial’. A significant number of respondents lack a basic kitchen set-up, and have for long never felt the need to have one. Their dependence on food delivery platforms is extremely high, which provides opportunities for dark kitchens and the food delivery business in general. Restaurants, on the other hand, will find it difficult to rely only on deliveries, given the nature of their overheads.

The other items considered essential under delivery include groceries, medical supplies, and a few indulgent categories such as skincare / cosmetics and liquor.

Online Education

A majority of respondents considered Online Education an essential service. This is significant in a couple of ways. Firstly, it emphasises the need for schools and colleges to strengthen their e- learning / distance learning initiatives, and to build capabilities in content and delivery that allow them to conduct classes virtually — through an owned or outsourced platform. This, in turn, requires them to invest in training their staff and students (in some cases parents too) to get accustomed to virtual learning.

The second opportunity in online education is for independent learning platforms to promote the importance and efficacy of ‘home-learning’. The sweet spot might lie in the middle, which requires home- learning platforms to collaborate with institutions to make online education more convenient, accessible and seamless.

60% respondents believe online classes/e-learning should be recognised as ‘essential’

It is clear that post-Covid-19 the education system which had barely evolved in the past few decades, will now have to go through changes that emphasise the importance of online education / learning at home. It’s a potential opportunity to transform the education industry.

Travel

Travel has been a top priority for most urban Indians over recent years. In wake of the current crisis, it also seems to be one of the categories that will face the largest impact for the longest time.

Across all segments, the general sentiment is to put all travel plans on hold. Social distancing and zero contact are probably the most relevant in this category. The onus is on all players in the travel segment to alleviate these fears by putting in place visible and impactful measures that help ease customers back into the category. This requires an over-investment in communication with customers in the most personal and transparent way possible.

Brands that are seen as being caring and empathetic with their customers will likely emerge as the preferred choice, and will evolve from the crisis stronger than those who are not.

Online Entertainment

The increase in people consuming content online has never been in doubt. If one of the key factors in making it more accessible was the launch of Jio, the Covid-19 crisis is definitely another watershed moment in terms of increased consumption of online content.

Almost all respondents surveyed have confessed to a significant rise in time spent on online content. This includes OTT platforms like Netflix and Hotstar, music platforms like Saavn and Spotify, and even content related to fitness and food on platforms such as Instagram and YouTube.

While content will always be the differentiator, a clear trend that emerged is the rise of LIVE content. LIVE was already gaining popularity especially among younger audiences, but the level of sharing, consumption and acceptance has significantly increased during the lockdown.

Lockdown gigs, fitness coaching, and panel discussions are formats that are probably here to stay. The implication of this on brands is significant with regards to the creation of fresh content that is consumed by appointment. Early adopters are likely to trial Masterchef classes, virtual gym sessions and coaching.

“For us artists, we have found a way to keep people entertained through live concerts online. These are actually quite intimate and accessible for everyone. People seem to have really taken a liking to this form of entertainment and this is something we would never have thought of before.”

-Nikhil D’Souza, Singer

We believe that this trend is here to stay, even in the post-Covid-19 environment. Consumers will expect content, and therefore brands, to be available on demand. An example of a brand that took the lead on this front is Nike with their Play From Home initiative.

Image source: www.nike.com

Q: Which of the following categories / services do you consider essential?

Chapter 05

WFH

The things that really matter. An understanding of what’s really important to consumers.

The lockdown has forced all of us to go back to things that matter. Many of the respondents we spoke to echoed this sentiment, with some even confessing that this was a blessing in disguise. Some picked up new hobbies, while others have reconnected with forgotten passions.

While we need to be prepared for the negative consequences of isolation on mental health, it must also be noted that for a significant set of the audience that we met, the lockdown has brought them closer to their loved ones and helped them revalidate themselves.

“This time has really helped me connect with my latent interests. I have genuinely managed to discover how to balance my lifestyle”

We firmly believe that these habits that have been formed or rekindled during the isolation phase, will remain an essential part of the daily lives even once the lockdown is lifted. This not only gives us an insight into the consumer in terms of what matters, but also provides brands with an incredible opportunity to think of meaningful ways to become a part of consumer lifestyles, and build better and more lasting connections with consumers in a zero-contact world.

The tag cloud below is a reflection of that. These are the top activities that the respondents have indulged in during the lockout period. While Netflix seems to be the only brand that gets a mention, there is a clear pattern in terms of the dependence on the web as a credible source of information, motivation and content.

Chapter 06

Look Out

An outlook on the impact of Covid-19 on customer sentiment and lifestyle

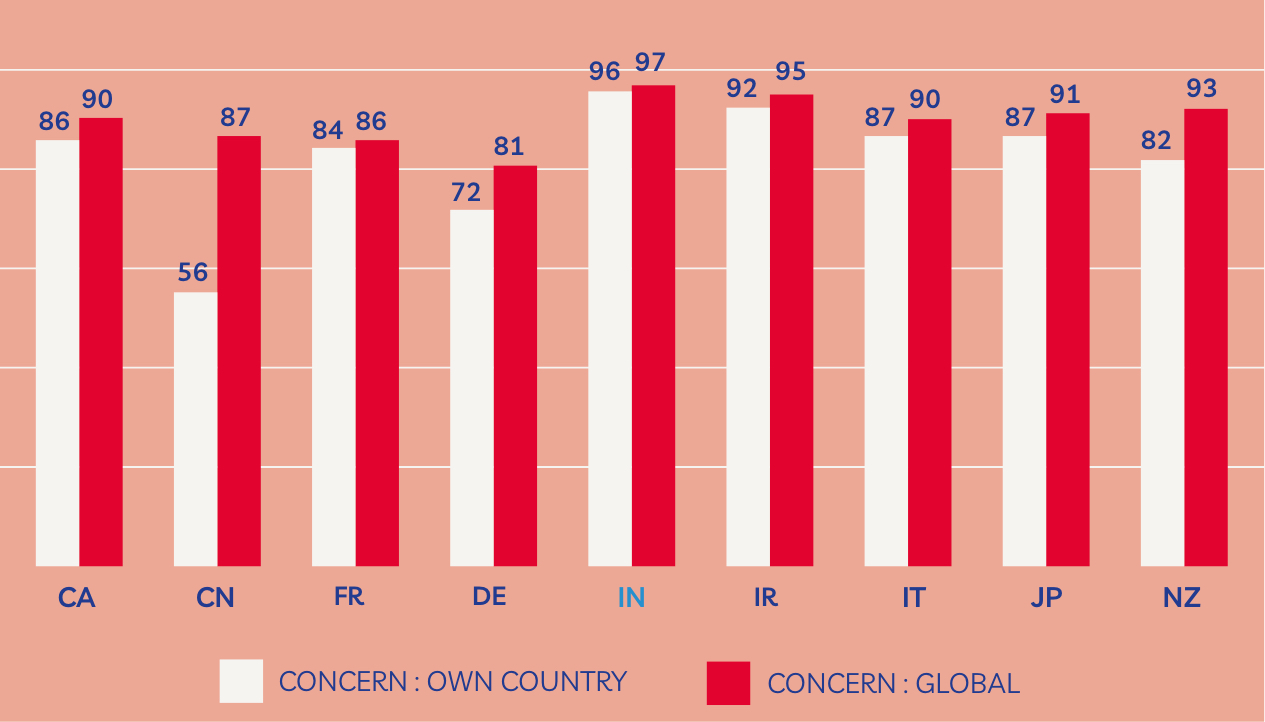

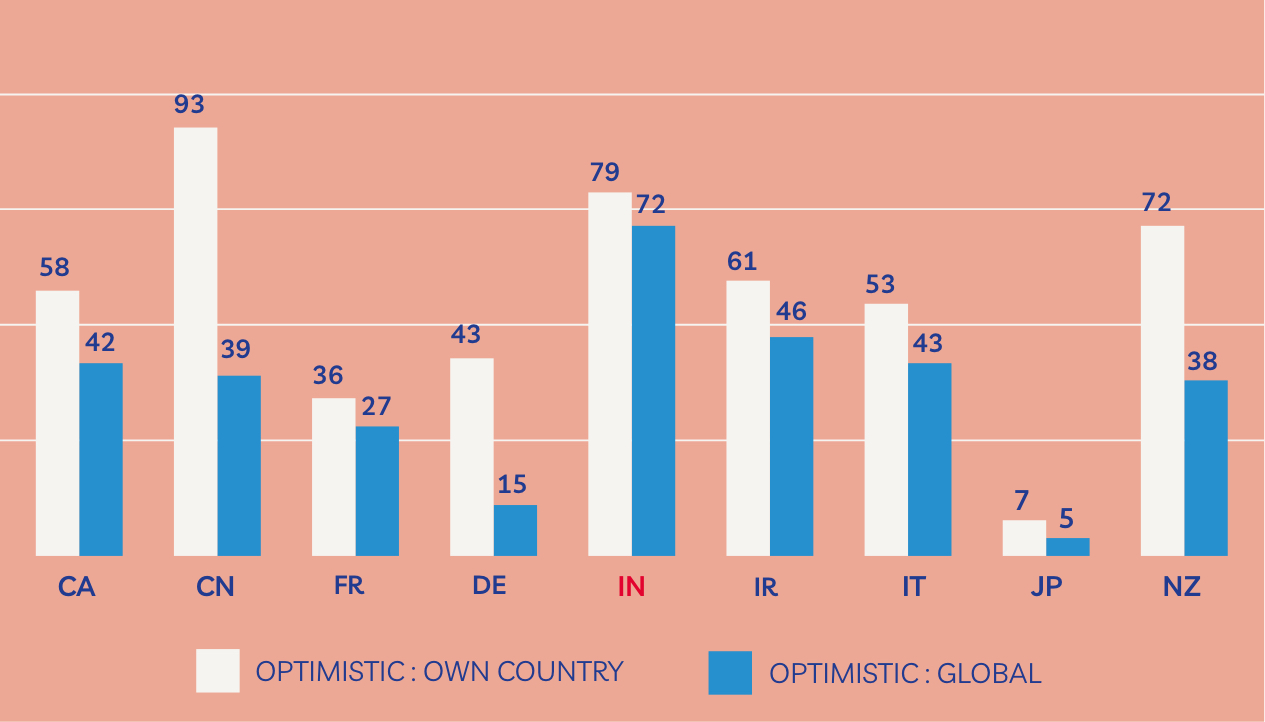

Here’s the good news. While it may seem gloomy given the level of economic activity and the extended lockdowns, the sentiment amongst the consumers is not that bad. While most agree that this will have a significant impact in the short term, they also believe that the recovery process will be just as fast. We cannot, and must not, undervalue the impact of optimism on the recovery process. Irrespective of the demographic, the common sentiment amongst consumers is fairly optimistic (see chart below) with most of them not seeing any significant impact in their lifestyle consumption patterns in the medium- to long-term.

There will be certain discretionary spends that will either get delayed or cancelled. However, the impact on all their other spends are less likely to be impacted. Of course there is concern about the short term. But the general sentiment and outlook is optimistic.

It is important for brands and businesses to take a long-term view, and not make hasty decisions aimed at immediate recovery.

Any action taken keeping only the short term in mind will, more often than not, have significant long-term repercussions for the brand.

A bulk of respondents believe that the recovery period would be greater than 6 months. From a business perspective, that eliminates the current calendar year.

In our opinion, this data should be viewed with a pinch of salt, purely because no one can truly know what the post-Covid-19 world will look like. We certainly hope the optimism is for real. Either way, it’s certain that positive sentiment can only benefit the recovery.

In our opinion, this data should be viewed with a pinch of salt, purely because no one can truly know what the post-Covid-19 world will look like. We certainly hope the optimism is for real. Either way, it’s certain that positive sentiment can only benefit the recovery.

% who say they’re extremely, very or quite concerned about the coronavirus / COVID-19 situation in their own country vs globally. Source: GWI Coronavirus Research April 2020

% who say they feel optimistic that their own country or the world will overcome the coronavirus / COVID-19 outbreak. Source: GWI Coronavirus Research April 2020

Our primary learning from all our interactions and conversations with consumers is the need for brands to define how they will connect with their customers in a zero-contact environment. It is the investment that organisations need to make in building one-on-one direct relationships with their consumers, which is not to imply that this has not been attempted in the past.

What will differentiate the winners from the losers is what we call the 3S of the new normal - Sincerity, Speed and Scale.

Sincerity

Simply put, this is about culture. Organisations need to imbibe a culture that is built around Customer Experience, driven by data, and powered by the right use of technology.

Speed

We’ve heard a fair deal about the importance of agility. For some reason, in the marketing world, the use case has predominantly been restricted to the speed at which brands churn out communication. That’s good, but not good enough. A core requirement for being agile is a stable foundation, and that’s what brands need to focus on. The question to ask is: how do I build a platform that enables me to build meaningful connections with my customers in real-time?

Scale

Probably the most frequently used word. The key difference here is the need to build for scale, rather than scale as you go. This is an investment mindset that requires commitment to the long term. A short /medium term approach to scaling will have very little impact. Partnerships will play a huge role in this. The need of the hour is to commit to the right partner - be it for technology, distribution, loyalty, or any other stream of marketing.

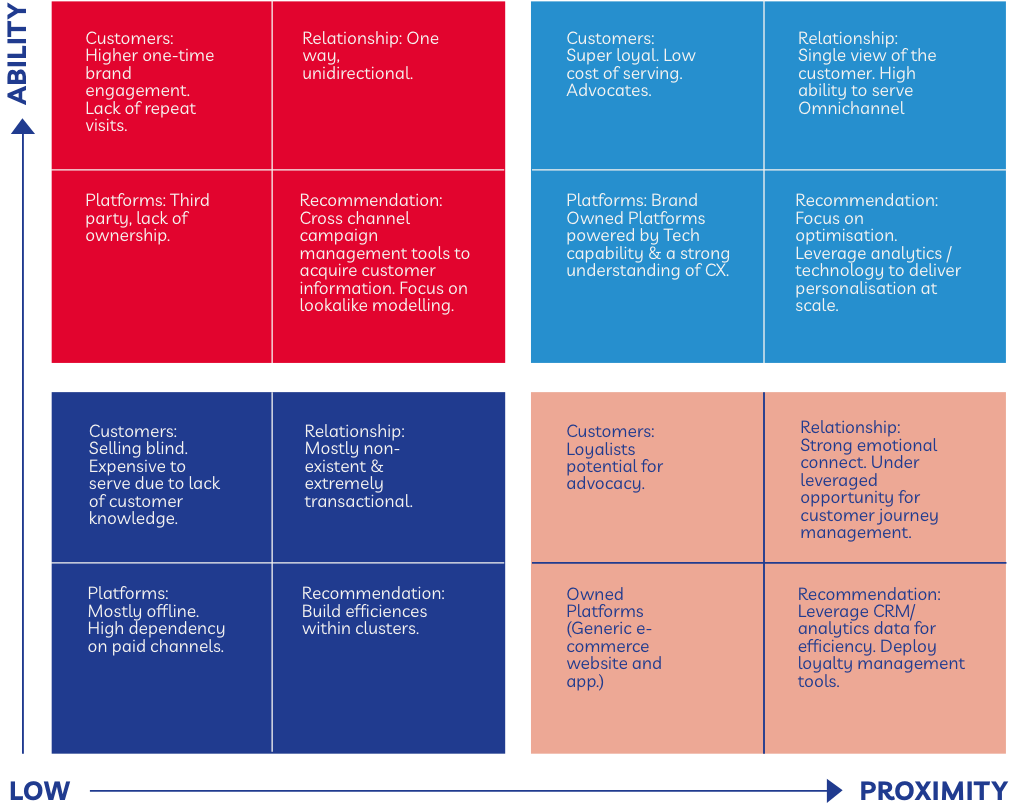

The 3S influences the two most important attributes of a ‘connection’ - Ability and Proximity.

A commitment to the 3S is critical for organisations to build meaningful connections with their customers in a zero contact world. It influences the two most important attributes of a ‘connection’ - The ability to serve, and, the level of proximity with the connection itself.

Chapter 07

Summary:

It’s Business As Unusual

What this means for brands

and marketeers in the ‘new normal’

The world will change. There will be a ‘new normal’. Covid-19 has been a wakeup call for many people on how much they spend, what they spend on, and what is really essential to them. Consumers will be more conscious of what they buy, and be far more rational than impulsive going forward.

The good news though, is that people are still quite optimistic. They still value the lifestyle and quality of life they currently enjoy. They will continue to invest in experiences, but less in ‘social experiences’. While they will continue to buy brands, they will actively seek more value than before. Moreover, they will not cease to invest in themselves - their health, education and entertainment. They will seek solutions that are zero-contact, but cater to their different needs.

Brands and businesses will need to adapt to this reality. We believe that in the long-term, the difference between the winners and losers will not be defined by what category you are in, but how you transformed your customer experience to a zero-contact world.

In the post Covid phase, our view is that on the demand side, there will be a significant pent up demand that helps certain categories like Personal care and F&B.

The challenges will be more pronounced on the supply side, given the guidelines on social distancing and shortage of labour.

Servicing demand will probably be a bigger challenge than creating demand. Demand generation will therefore not be the obvious objective. Instead, brands should be looking at building deeper connections with customers through meaningful brand building initiatives and relevant interceptions in their customer journey using the right tools and intelligence.

“At Wakefit.co, our DNA has been built on the pillar of customer experience. We believe that we need to stay alongside our customers even after a purchase has been made - in fact, our relationship with the customer just begins when they get their first Wakefit product. This fundamental belief has made us improve our R&D, address customer queries and counsel them on various occasions.The same DNA will hold us in good stead amidst the lockdown too.”

-Chaitanya, Founder, Wakefit

‘Connections’: A framework for segmenting your customer base

What is this framework:

The ‘connections framework’ is our approach to how brands should evaluate their customer base and therefore how they are positioned to connect with consumers in a zero contact world.

How to use this:

This framework is a good starting point for brands that are keen on building a strong connection with their customer base. Brands need to segment their consumer base on two parameters:

Proximity

Ability to Connect

Proximity:

The degree of separation between you and your end customer. High proximity - the customer is registered on your owned platform (offline or online) and therefore exists on your database.

Ability to Connect:

The capability to acquire knowledge about your existing customer at an individual level. The knowledge includes his/her transactional, behavioural & preferential data.

Building connections with customers is a dynamic journey, and is different for each brand and category. It is a process that we believe will be the differentiator between winners and losers in the ‘new normal’.

As we wrap up this report, we wish you luck in manoeuvring these times. Do remember the 3S — Sincerity, Scale and Speed — while charting your path towards making connections in a zero contact world.

Contributors

Ajay Ram

Partner - Design

Spring Marketing Capital

Email: ajay@springmarketingcapital.com

Azharuddin A

Partner - UX

Spring Marketing Capital

Email: azhar@springmarketingcapital.com

Ibrahim Rayintakath

Creative Associate

Spring Marketing Capital

Email: ibrahim@springmarketingcapital.com

Lekha Shastry

Creative Associate

Spring Marketing Capital

Email: lekha@springmarketingcapital.com

Raghunath J

Partner - Technology

Spring Marketing Capital

Email: raghu@springmarketingcapital.com

Rohan Talati

Portfolio Managementy

Spring Marketing Capital

Email: rohan@springmarketingcapital.com

Tom Jose

Partner - Interaction Design

Spring Marketing Capital

Email: tom@springmarketingcapital.com

Vineet Gupta

Founder and Partner

Spring Marketing Capital

Email: vineet@springmarketingcapital.com